geothermal tax credit canada

The tax credit can be used to offset both regular income taxes and alternative minimum taxes AMT. 48 of the tax code under sec.

Highlights From The Indonesia Canada Energy Transition Webinar By Bahar And Osler

On a 100-point EnerGuide rating scale if your home is built to exceed a rating of 80 you will receive a 1500 rebate.

. The tax credit can be claimed through the income tax system either on the individual T1 income tax return or the corporate T2 income tax return. When financing your new geothermal system you can choose one or both of these loan types. If the federal tax credit exceeds tax liability the excess amount may be carried forward into future years.

Depending on your age and living situation you can be eligible for a credit between 25 and 1085. Responsibility for administering the tax incentives is shared between the CRA and Natural Resources Canada NRCan. If the rating is 82 you will receive a 3000 rebate.

Nova Scotia Heat Pump Rebates. Individuals corporations and not for profit organizations can claim the refundable tax credit for eligible geothermal installations. 75 of the purchase price of a heat pump that qualifies for the manufacturers geothermal energy equipment tax credit.

The tax credit is available for new construction or existing homes owned by the tax payer. Green Energy Equipment Tax Credit The Government of Manitoba currently offers a tax credit for geothermal heat pump systems 75 15 and solar thermal energy systems 10. Geothermal - a 75 tax credit on the purchase of a geothermal heat pump and a 15 tax credit on the cost of installation.

A 10 tax credit on the purchase and installation of all equipment used to convert solar energy into electricity. Residential credits will remain at 26 of the total installation cost through 2022 stepping down to 22 in 2023. The purpose of this Chapter is to describe these incentives and the criteria necessary to benefit from them.

And if it. The Alberta Government and Climate Change Central have made available up to 10000 for new energy efficient homes. Check with your local installer and tax professional for more details.

Geothermal equipment that uses the stored solar energy from the ground for heating and cooling and that meets ENERGY STAR requirements at the time of installation is. Check with your local installer and tax professional for more details. The commercial tax credit will remain at 10 through 2021.

Credit for that effort goes to Frank Hooper professor emeritus of mechanical engineering at the University. A grouping of incentives related to energy efficiency from provincialterritorial governments major Canadian municipalities and major electric and gas utilities are offered below. For more information or assistance on the Green Energy Equipment.

The tax credit applies for geothermal installations in new and existing homes. The credits will expire on January 1 2024. The Geothermal Tax Credit however is a non-refundable personal tax credit.

The federal government is offering a 10 tax credit on the installed cost of a geothermal system. Ontario does not currently have any geothermal heat pump rebates. In December 2020 the tax credit for geothermal heat pump installations was extended through 2023.

The tax credit equals 26 of the eligible system costs including the heat pump ground loop field etc. Ontario Energy and Property Tax Credit This credit is available for eligible applicants that either rent or pay property tax. Theres no limit to the amount of times it can be claimed so if the taxpayer owns multiple homes the tax credit is.

Spending on geothermal heat pump property adds to your homes cost basis but also must be reduced by the amount of the tax credit received. If you credit is greater than your tax liability it will not generate a tax refund. There is no limit to the number of times the credit can be claimed so if the taxpayer has more than one home the credit can be claimed for each home where geothermal equipment is installed.

When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump. Alberta Financial Incentives to go Geothermal. Atlantic investment tax credit of 10 of the cost of prescribed energy generation and conservation properties.

The Consolidated Appropriations Act 2021 signed into law on December 27 2020 extends the federal tax credit for geothermal heat pump installations through 2023. There are a number of residential geothermal tax credits and rebates available in both Canada and the United States. The tax credit equals the total of.

Its always a good idea to consult your tax professional for best practices in claiming credits. The section 25d federal income tax credit thats available for new residential geothermal systems at up to 26 of the eligible project cost. 15 of the capital cost of geothermal energy equipment excluding the cost of the heat pump.

A 10 tax credit on the balance of the cost of the geothermal system if installed by a member of the Manitoba Geothermal Energy Alliance. United States Federal Government. A further 5 tax credit is provided to manufacturers on the sale of heat pumps that are made in Manitoba and sold for use in Manitoba.

Included are a 10 commercial Investment Tax Credit under Sec. This tax credit is uncapped and applies to the all of the installation related expenditures. Purchasers can claim a credit on geothermal heat pump systems that meet the standards set by the Canadian Standards Association.

Browse through the options below to find a rebate that applies to you. It can only reduce or eliminate your liability how much money you owe to the IRS. A 12-month or 18-month loan that covers your geothermal tax credit ie.

The tax credit applies for geothermal installations in new and existing homes. 48 of the tax code under Sec. It has been about 60 years since the first system of this kind was installed in Canada.

Solar Panel Rebate Program pending Efficiency Manitoba announced in 2019 they will have a permanent solar panel rebate program in place by 2022. Tax credit for eligible system costs including the heat pump ground loop field etc. There are no commercial tax credits offered by the provincial governments in Canada.

Ontario does not currently have any geothermal heat pump rebates. Geothermal tax credit canada. The credit is equal to 26 of the eligible system costs including the heat pump ground loop field etc.

HR 1090 reinstitutes and extends through 2021 commercial and residential installation tax credits for geothermal heat pumps. As part of The American Recovery and Reinvestment Act section 25D of the Internal Revenue Code projects utilizing ENERGY STAR qualified geothermal heat pumps receive a 26 US. The Section 25D federal income tax credit thats available for new residential geothermal systems at up to 26 of the eligible project cost.

Heat Pump Rebates in Canada Ontario Heat Pump Rebates.

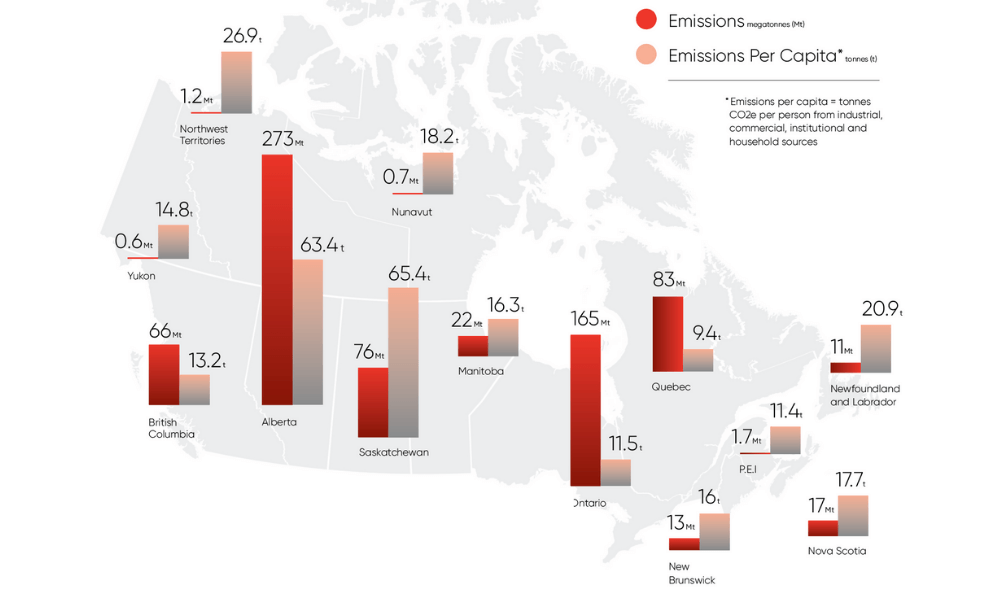

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights

Heat Pump Rebates In Various Canadian Provinces

Heat Pump Rebates In Various Canadian Provinces

Highlights From The Indonesia Canada Energy Transition Webinar By Bahar And Osler

7 Best Canadian Renewable Energy Stocks For Green Investors 2022

Late Summer By The Lake Beautiful Nature Lake Science And Nature

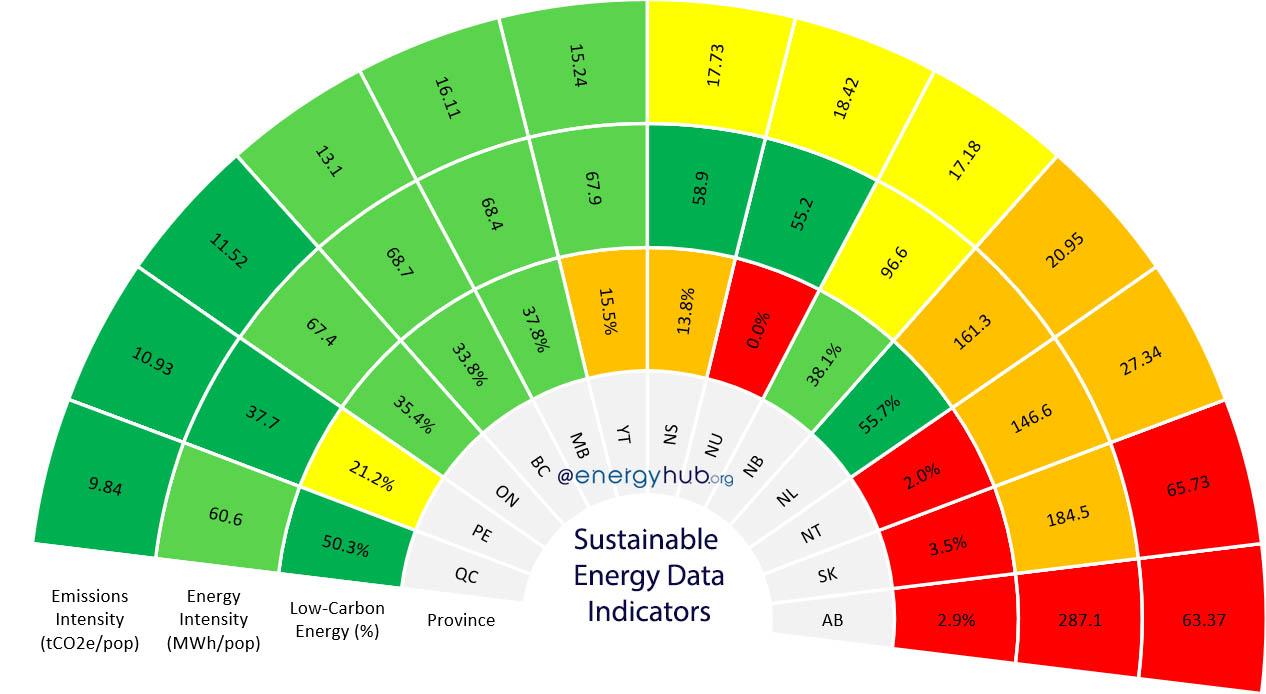

Sustainable Energy Indicators Canada 2021

Titanic Director James Cameron Wants You To Use Solar Panels So Badly He S Making The Technology Open Source Used Solar Panels Solar Tree Solar Panels

Government Of Canada Energy Rebates 2021

Minnesota Map Moved Minnesota State Minnesota Moorhead Minnesota

2022 Government Heating Cooling System Rebates Furnaceprices Ca

Renewable Energy Country Attractiveness Index Us Dropped From 1st To 3rd The Full Pdf Is Avail Vi Renewable Energy Solar Energy Projects Solar Energy Facts

Net Zero Readiness Index Canada Kpmg Global

Incentives Grants Geosmart Energy

Us Canada Expand Clean Energy Cooperation Ihs Markit

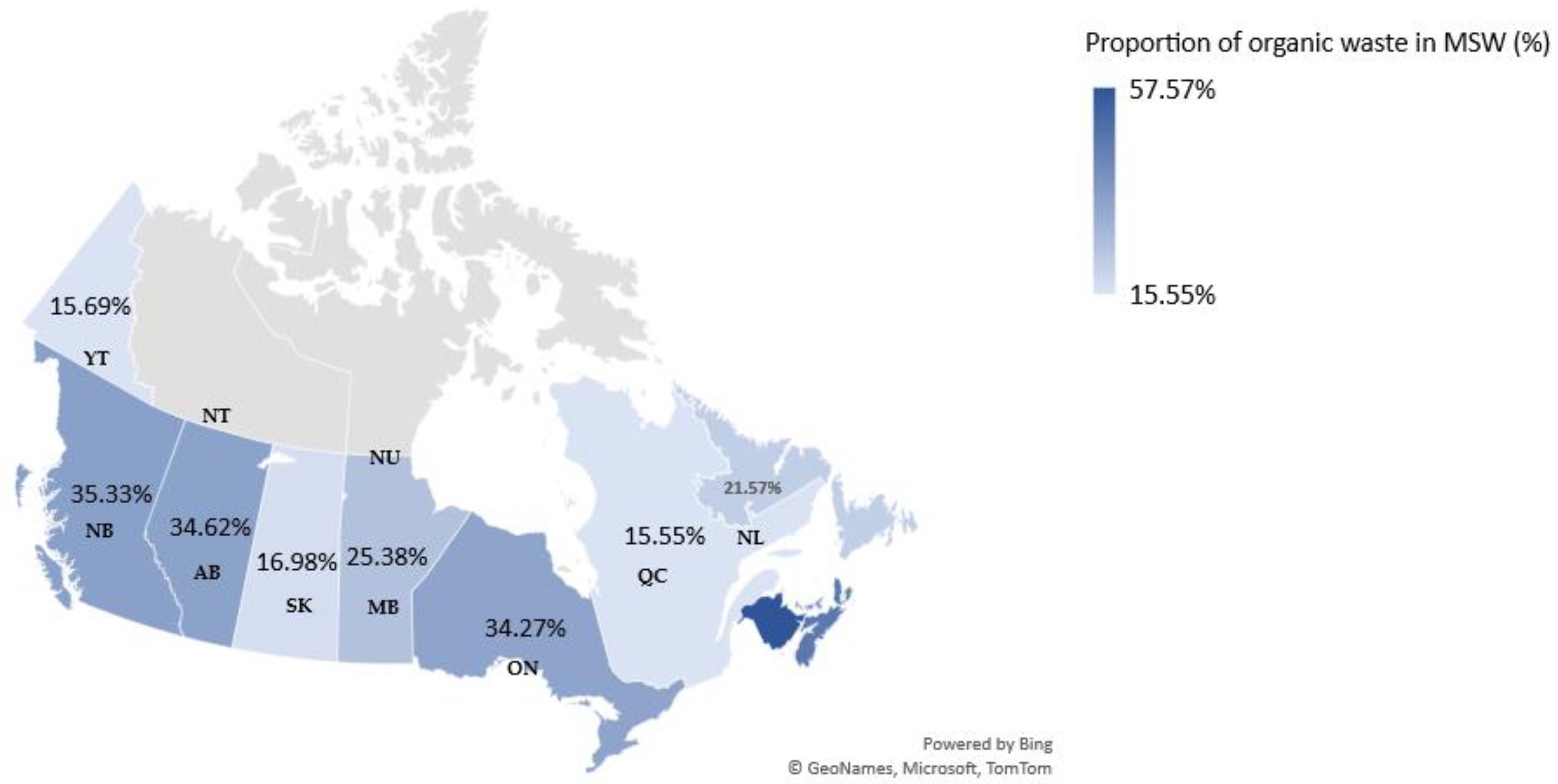

Energies Free Full Text The Current Status And Future Potential Of Biogas Production From Canada Rsquo S Organic Fraction Municipal Solid Waste Html

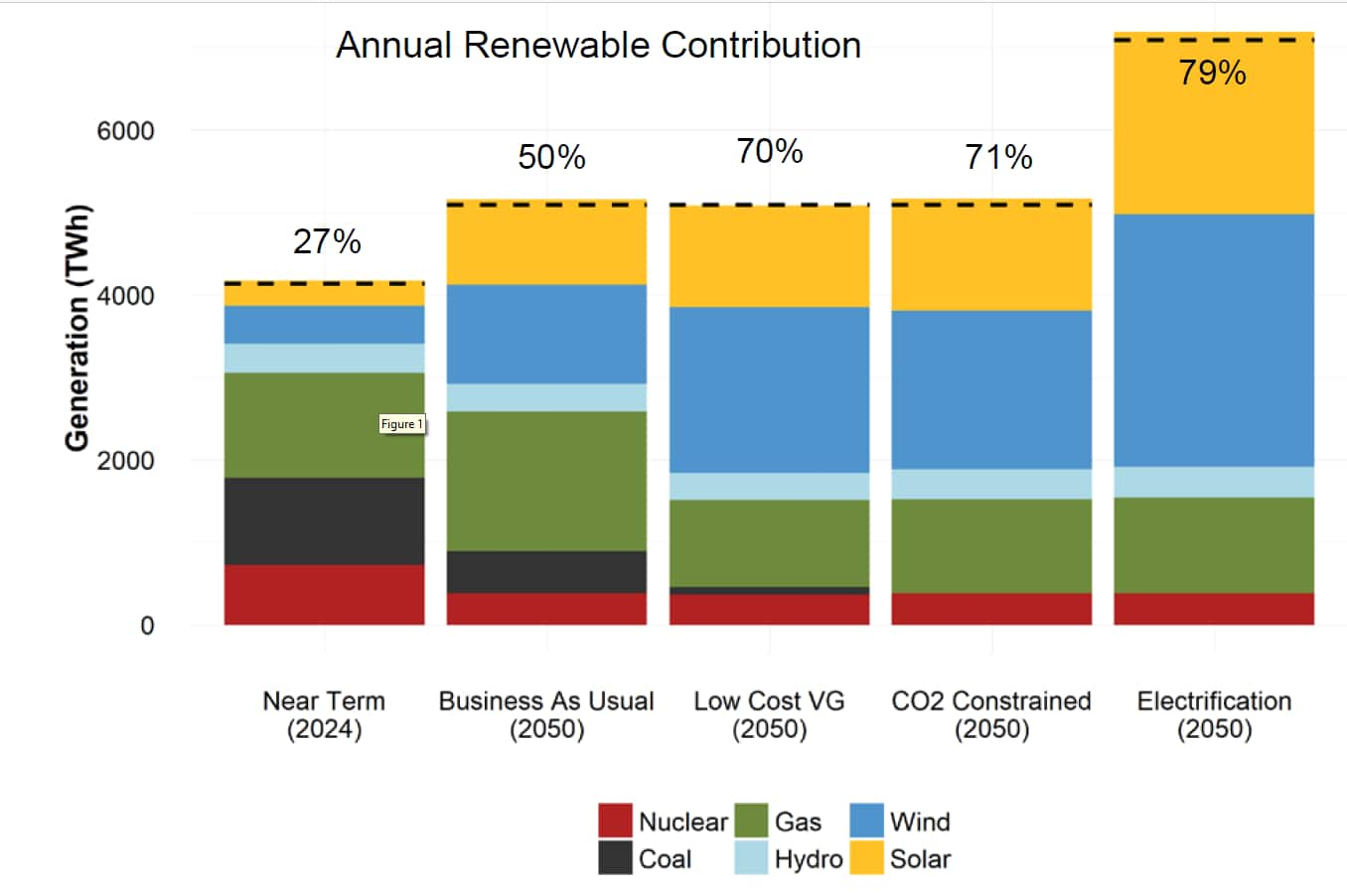

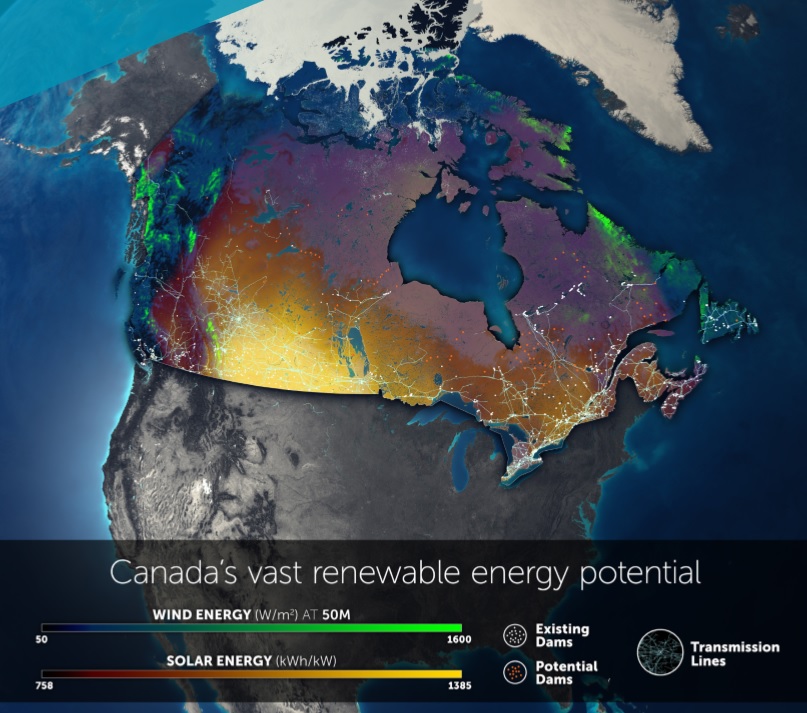

Here S How Canada Could Have 100 Renewable Electricity By 2035 The Narwhal